Hey guys, This is Yaniv writing.

Today we will talk about new SPAC ticker symbol: $OAC this company is still completely under the radar (current price is $10.50) and could potentially become 10x multi-bagger or more in the future, I will write my main keys and why I’m so bullish on it, so let’s get into it:

Who are we dealing with?

OakTree- Very shrewd and principled investors, Includes Founders Fund which is funded by Peter Thiel. The fund has invested an early stage in PayPal, Airbnb, SpaceX, Facebook, Stripe, Palantir Technologies et cetera. (SEC Source Exhibit 99.1)

Pretty simple deal. Pump up the balance sheet with $245mn cash.

“We founded Oaktree Acquisition Corp. to partner with a high quality, growing company that will benefit from a public currency for its next leg of growth,” said Patrick McCaney, CEO of Oaktree Acquisition Corp. “Hims & Hers is an ideal match and represents a unique opportunity to invest in a rapidly-growing company that is modernizing the delivery and accessibility of healthcare and wellness solutions. Over the past two years, the Company has experienced significant growth bolstered by the continuing widespread adoption of telehealth and digital patient care solutions – and we think this is just the beginning. We look forward to partnering with Hims & Hers to accelerate the expansion of its high-quality, end-to-end care services across the broader healthcare marketplace.”

So what is Hims, Inc?

Simply go to their website forhims.com and pay an affordable telehealth check-up ($39 only) and get a prescription personalized for you.

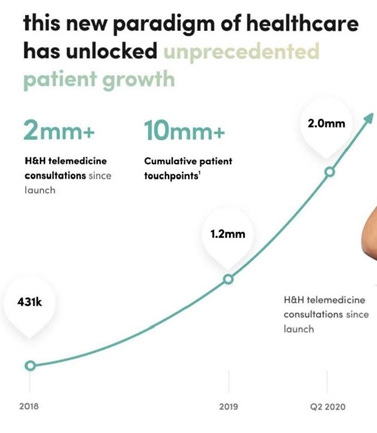

So is this company can really get some traction? Since 2018 they already got over 2mn cumulative telemedicine consults (in less than 2 years). For instance, if we’re comparing this to Teladoc it took them 13 years to power 1 million medical consults. Hims and Hers powered > 1 million in their 1st year of ops, that’s incredible growth.

Andrew Dudum, CEO and founder of Hims & Hers said: “Hims & Hers was founded to make it easier and more affordable for everyone to get the healthcare they need. We remain committed to advancing that goal as we expand into new categories of care and build an enduring healthcare company that brings choice, affordability, and access to consumers.”

People love their prescriptions, 65 NPS score VS 9 for other health providers is a huge delta and can impact the potential growth, creates brand influencer, and lowers the marketing costs.

What is NPS? Net Promoter or Net Promoter Score (NPS) is the percentage of customers rating their likelihood to recommend a company, a product, or a service to a friend or colleague as 9 or 10 ("promoters") minus the percentage rating this at 6 or below ("detractors") on a scale from 0 to 10. Respondents who provide a score of 7 or 8 are referred to as "passives" and enter into the overall percentage calculation. The result of the calculation is expressed without the percentage sign.

Logistics numbers: 800K consults in half-year with 240 physicians that imply 4.4K consults per day, 3 shifts/day = 1.5K per shift. 80 physicians per shift equate approximately to 19 consults per shift per physician (about 2-3 per hour).

So what is the actual business model? since the $39 appointment considered a really low price and most of it goes to the physician how they are actually making money then? Hims/Hers have their own branding of products that they’re selling with their prescription (products for hair/skin/care) it seems like a disruptive model that will continue to increase market share.

The moat in here reminds me a bit of Roku, Inc. ($ROKU) the reason why is because a lot of people think Roku, Inc. is a device company but most of their revenue (97%) comes from the people that actually using the platform and it generates ad-revenue within their system platform or their channel. Roku is up over 170% last 6 months and I have a position.

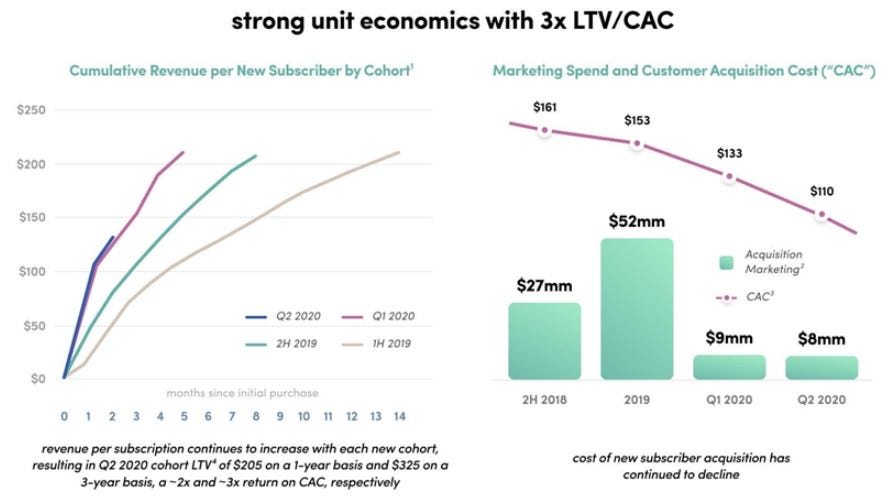

Let’s talk financials. So the unit economics numbers look solid: each year the cohort of each user that is getting acquired starts spending more and more in the long-term. E.g. 1H’2019 Cohort spends ~$200 by month 12 at a 70% GM that’s $140 vs. $153 in CAC, I like seeing cohorts revenue increase while CAC decreasing.

CAC in 2018 was $161 to acquire new user vs $110 in Q2 2020, ~3x 3-year LTV-to-CAC return ration:

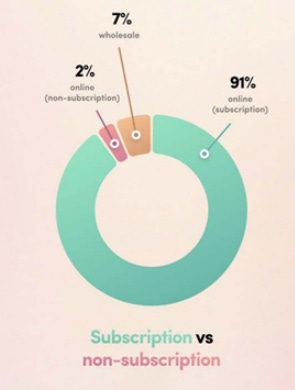

Conclusion: Once you have a customer they are locked in. They also do RX hair loss and skin products as well as have a bunch of generic branded OTC products and Telehealth services at an affordable price that beats all the other telehealth competitors by half or more ($39 only per visit) the reason for the attractive low price is to gain faster market share and increase their revenue from their in-house wellness products they’re selling after the user visit (turns in most cases into subscription recurring revenue). In fact 91% of their current revenue comes from online subscription:

They have 2 different brands: forhers.com (Female version) and forhims.com (Male version)

They are Branded Telehealth and their growth has been crazy with an early stage and COVID-19 will continue to accelerate the business growth more than expected.

The author is long stock in $OAC at the time of publication.

According to LinkedIn hims & hers has 33 job openings which are a great sign for their continuation of exponential growth (currently about 250 employees count).

CEO interviews:

Episode 91: Andre Dudum - Founder & CEO at “Hims & Hers”, Cofounder of the Venture-Builder, “Atomic”

Andrew Dubum: Bold Strategies That Propelled Hims & Hers Into Unicorn Status

Telehealth company Hims & Hers to go public via SPAC

If you like my research please follow and subscribe my progress to show your support:

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Yaniv does not engage in rendering any legal or professional services by placing these general informational materials on this website.

Yaniv specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

Yaniv makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Amazing research, i have 1200 shares right now. Let's see how much they're worth a year from now

What's the deal's financials? How many shares are outstanding today? how many will be issued to sponsors+pipe+founders? How about the warrants (how many, what's the price)?